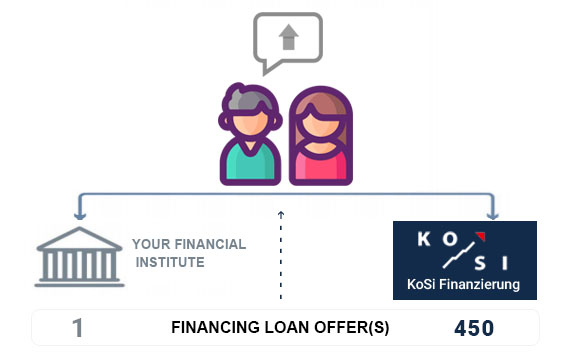

When it comes down to real estate financing, your bank offers a limited scope, resulting in limited options for you. The chances that you recieve the best loan for your needs are rather slim. The majority of banks are very restricted when it comes to fine-tune a financing offer. Due to the insufficient customisation, it is usually the case that you will not be presented with the cheapest option on the market.

By using our licensed credit platform, we can query up to 450 banks simultaneously within seconds. The extent of these inquiries goes beyond the possibilities of the average consumer. We design a suitable financing option by making the right questions and drafting your individual plan. Our forward-looking approach enables the adaptation of individual credit parameters. This results, for example, in the support of your financial needs in the case of planning further acquisitions and investments in the future. This supports your financiancial needs, for example, for planning future acquisitions and investments.

The finance services sector is a mine field, a jungle of technical terms. For this reason, the qualification to be legally able to advise you is very high. In this section you will find out in detail why.

There are many types of loans and, depending on your life situation, income, wishes and (realistic!) saving rate, some loan constellations are oout of reach. There are simply no “one-fits-all” solutions. We will provide you orientation to dodge the mines and find your way through the labyrinth.

As you may have suspected, the number of combinations is nearly infinite. By iterating several times the options during our consultancy, we will narrow them down to the final loan provider.

Costs: we do not charge a processing fee or other additional fees for advising and arranging your financing.

If the loan you requested is successfully brokered, we will receive remuneration from the lender.

We work in your interest and securing your financial future is our priority.

Copyright © 2020 KoSi Finanzdienstleistungen GmbH